The Asian/Pacific markets closed down across the board. Hong Kong, South Korea and Taiwan dropped more than 1%. Europe is currently mostly down. Austria is up 1%. France is down 1% and Greece is down 3.3%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

Yesterday after the close JP Morgan announced a $2 billion trading loss. The S&P futures immediately dropped about 12 points (right now they’re down 6.5). Why would the market sell off when JPM’s trading division loses money? JPM is half bank and half hedge fund. If the bank part does well/poorly it implies something about the economy. But if their gamblers place big bets and lose, who cares? It implies nothing. It doesn’t mean the economy is doing better or worse or anything. It just means they placed big bets and were wrong. There are 1000’s of hedge funds out there, and we never know how any are doing…and we don’t really care either. But since JPM happens to also be a bank (and is publicly traded), we get regular reports. I still don’t think it matters…other than the fact that it’s obvious the idiots didn’t learn anything from the financial crisis.

Heading into today, the Dow is down 1.4% for the week, the S&P and Nas about 0.8%, and the Russell is flat. Considering the news in Europe, these losses aren’t bad. A good up day would have put the market’s weekly performance in the “pretty good” category. It’s still possible, but with the opening gap down, it’ll be much harder.

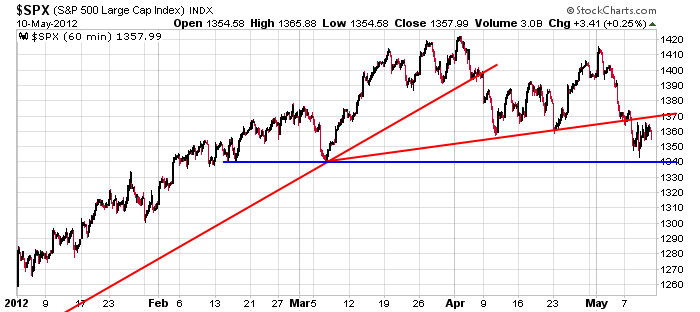

Here’s the 60-min S&P chart. Over the next day or so support is at 1340 and resistance at 1370.

On an intermediate term basis, the path of least resistance is down. On a short term basis the market may be getting close to being overextended to the downside. We’ve had lots of good shorts the last couple weeks. The risk/reward for entering new shorts is not great at these levels. Patience is needed. Jason Leavitt. http://www.leavittbrothers.com/

No comments:

Post a Comment