The Asian/Pacific markets closed mixed. Australia, Malaysia, Japan and South Korea closed down; Hong Kong and India closed up. Europe is currently mostly up. Austria and the Czech Republic are standout losers while France and Norway are winners. Futures here in the States point toward a moderate gap up open for the cash market.

The dollar is flat. Oil is up slightly; copper is down. Gold and silver are up.

Facebook has raised the price range for its IPO. I’ve see more negative press than positive the last week or so. In my eyes this means analysts are trying to downplay the stock so it doesn’t do as well on opening day so they can buy it. FB isn’t stupid. They don’t want a repeat of LNKD who left a lot of money on the table, so they’re upping the range.

Moody’s cut the long term debt and deposit ratings for 26 Italian banks.

GRPN reported its first quarterly profit yesterday. The stock rallied 18.5% (obviously the news leaked early) and is up another 30% in pre-market trading today – that’s almost 50% total.

HD is down after missing expectations.

AVP is down 14% after Coty withdrew its $10.7 billion takeover bid.

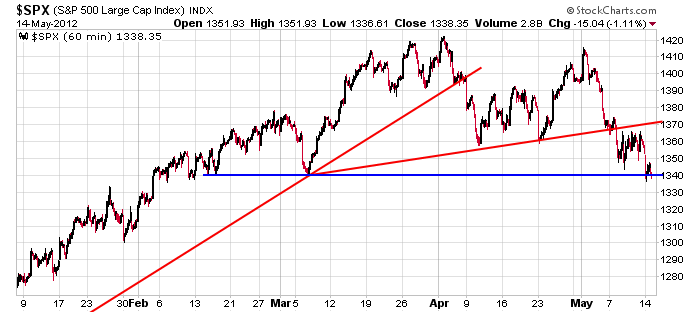

There hasn’t been much for the bulls to cling to lately. We’ve gotten many large opening gap downs, and although on every occassion the bulls stepped up and prevented a total catastrophe, the S&P has dropped 7 of 9 days and yesterday closed below 1340 – a level the media is now keying on. The path of least resistance points down, but remember, the biggest up days occur within downtrends. Have a plan. What will you do if the market suddenly rallies a bunch?

Here’s the 60-min S&P chart. Closing below 1340 is the third time the index has closed below a key suppport level. Allowing for some wiggle room, I won’t consider it official until we get some separation and the price stays down there, but when it does, the outlook for the market will not be good. In the near term, a bounce to 1370 is very doable.www.leavittbrothers.com

No comments:

Post a Comment